Streamline Your Fact-Finding Process

Empowering mortgage advisers with digital diligence tools to save time, reduce errors, and enhance client experience.

Empowering mortgage advisers with digital diligence tools to save time, reduce errors, and enhance client experience.

Transforming Mortgage Processing

We're on a mission to revolutionise how mortgage advisers work. By replacing outdated paperwork with intelligent digital tools, we're helping professionals spend less time on admin and more time with clients.

According to IRESS's 2023 Financial Advice Efficiency Report, only 42% of UK advice firms consistently use digital tools for fact-finding. Our platform bridges this gap, reducing the traditional 5-10 hours spent on fact-finding and compliance per client.

The FCA has identified that mortgage applications remain "manual and error-prone." Our digital tools ensure accuracy and compliance, helping prevent the documentation errors that UK Finance reports as a leading cause of mortgage delays.

Our solution is designed to help firms process significantly more applications, improving overall efficiency and throughput.

By automating manual tasks, we're aiming to save professionals hours every week — time that can be reinvested in higher-value work.

We're working to drastically reduce human error through intelligent automation and streamlined workflows.

We're here to accelerate that shift — empowering firms to stay competitive by embracing modern, digital-first operations.

Tools That Work For You

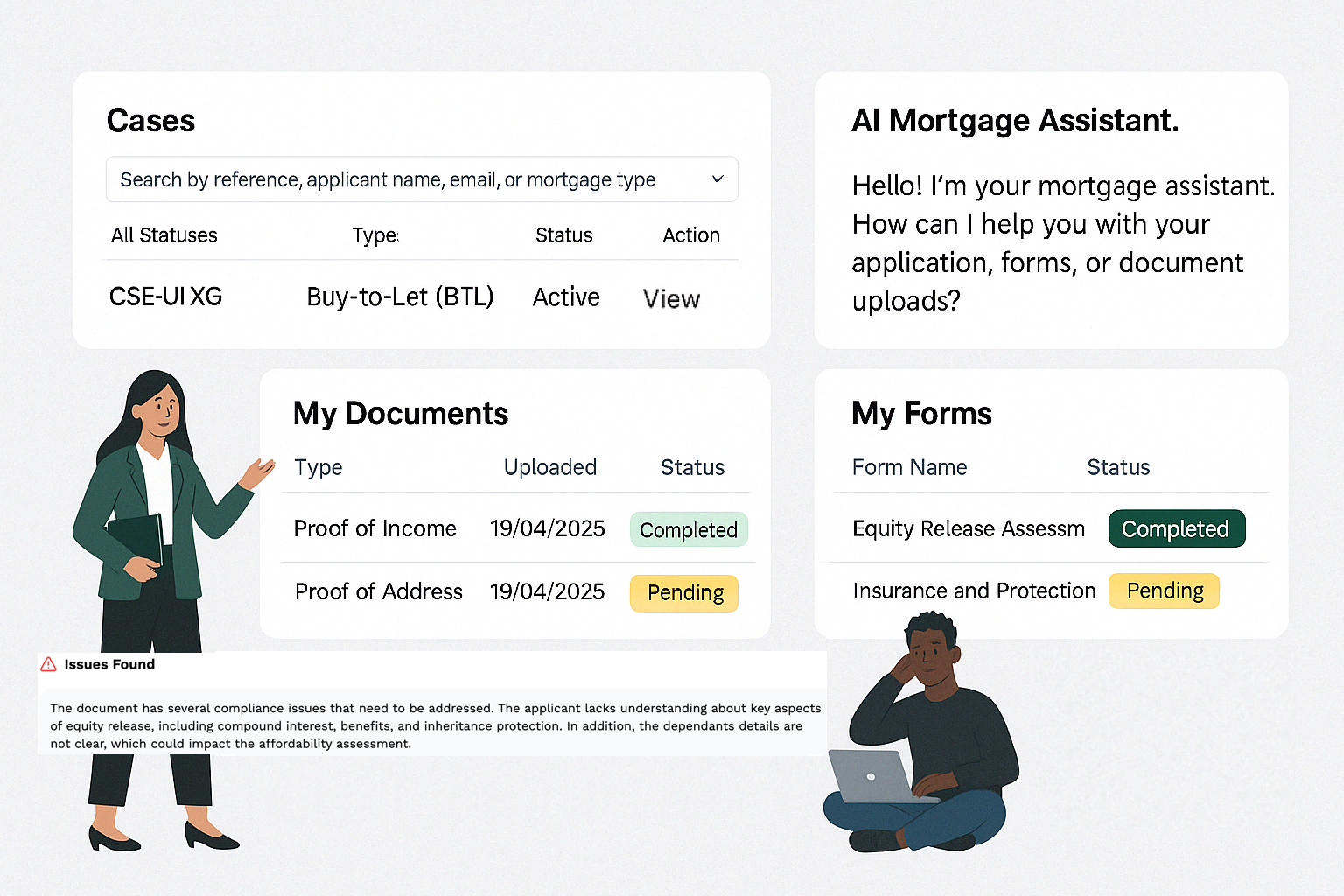

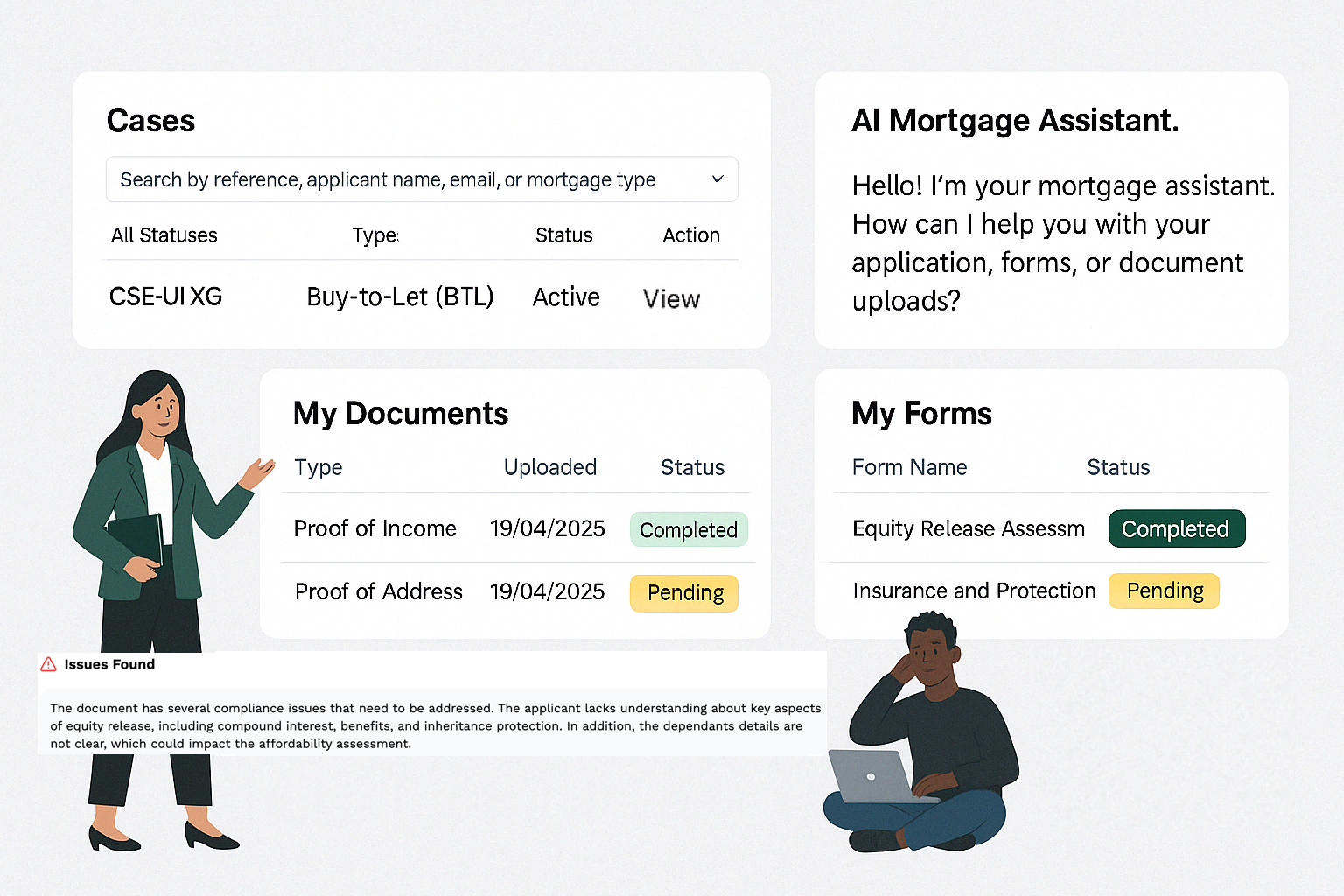

Experience a complete suite of intelligent tools designed specifically for mortgage professionals. From automated fact-finding to AI-powered compliance checks, we've got you covered.

Get started with Cleera in four simple steps.

Create your profile and customise your fact-finding templates.

Invite clients to complete their fact-finding forms securely.

Review completed forms and verify documents automatically.

Generate compliant reports and process mortgages faster.

Reduce admin work and speed up processing time.

Automated checks prevent costly mistakes.

Improve client satisfaction with a seamless experience.

Stay compliant with automated checks and secure data handling.

Be among the first to experience Cleera's revolutionary mortgage processing platform. Our private beta programme offers exclusive early access and the opportunity to shape the future of mortgage technology.

Get exclusive access to our platform before general release, with priority support and direct input into product development.

Beta participants will receive special introductory pricing and extended trial periods when we launch.

Help shape the future of mortgage technology with direct access to our development team and regular feedback sessions.

Choose Your Plan

Select a plan that fits your practice. From independent advisers to large firms, we have the right solution for you.

£49.99 /month

Perfect for independent mortgage professionals

£99.99 /month

For independent advisers and small teams

Custom pricing

Tailored solutions for large firms

Frequently Asked Questions

Yes! We offer a 14-day free trial with no credit card required. You'll have full access to all features during the trial period, allowing you to thoroughly test our platform and see how it can benefit your workflow.

We take security seriously. Your client data is protected and we comply with all relevant data protection laws including GDPR. Data is secured with data encryption at rest and in transit. Access is controlled with comprehensive role-based access control. Secure password hashing and storage is used. Our systems are regularly audited and updated to ensure effective security.

Yes! Our platform allows you to tailor form questionnaires to suit your workflow. You can create custom templates, add or remove fields, and organise questions in a way that makes sense for your business. All forms are fully compliant with regulatory requirements while maintaining flexibility for your needs.